Taxing Patience

Nigeria's tax reforms are technically sound but could face collapse due to a significant public trust deficit, as citizens demand visible service delivery for compliance.

Nigeria’s tax reform is navigating a profound crisis of legitimacy, not merely public resistance. The Tinubu administration’s push to implement the 2025 Acts demonstrates political will, but SBM Intel’s survey findings reveal a foundational problem: a severe trust deficit where more than two-thirds of citizens completely distrust the government’s use of tax revenues.

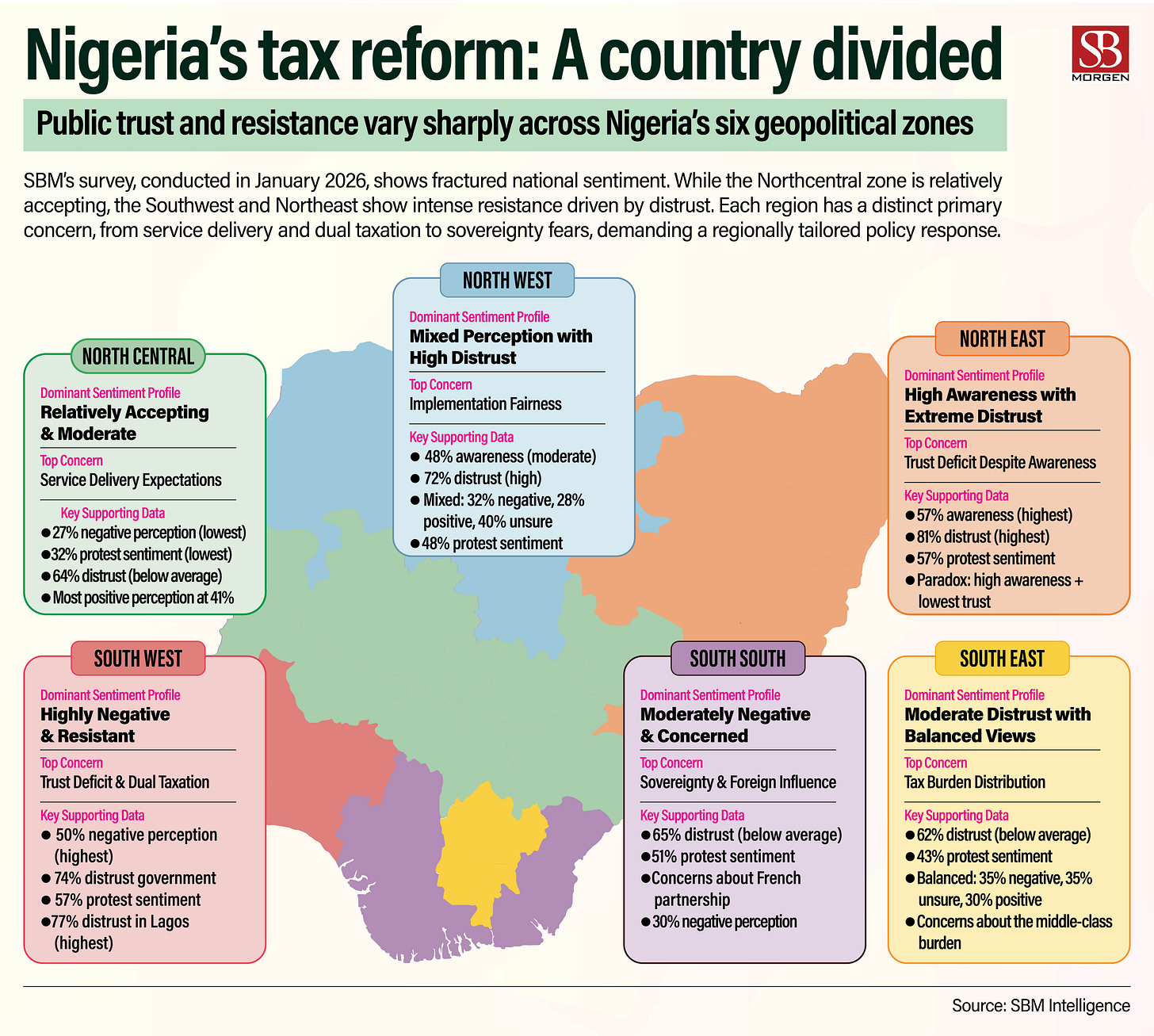

Our core insight is that opposition is not driven by the scale of the fiscal adjustment, which is modest at 1-1.5% of GDP. Instead, resistance is fractured and deeply felt, where enforcement becomes visible. The report uncovers stark regional disparities. In the Southwest, particularly Lagos, high awareness correlates with the strongest resistance (half of respondents have a negative perception of the new law), fueled by concerns over legislative integrity and the perceived burden on the visible middle class. In the Northeast, exemplified by Bauchi, distrust peaks at a whooping four-fifths, heavily influenced by geopolitical suspicion of the partnership with French tax authorities, widely framed as “digital colonialism.”

This presents a dual challenge. For the formal sector in commercial hubs, the lowered bank reporting thresholds make the reform feel like a targeted “middle-class tax.” For the critical informal sector, which the report notes already pays daily levies to non-state actors, the state’s new taxes are seen not as a replacement but as an additional layer of extraction. The path to compliance, therefore, is explicitly transactional. The data are clear: three-quarters of citizens would increase their willingness to pay only if there were visible improvements in electricity, roads, and security.

In essence, this report concludes that the reform’s success hinges on a precarious “tax swap.” The state must rapidly demonstrate it is more legitimate and effective than the informal extractors it seeks to replace. Without immediate, tangible service delivery to rebuild the shattered social contract, this technically proficient fiscal overhaul risks becoming a socially divisive failure. The gamble is not on revenue collection, but on restoring public trust.