Zero Tariffs

China plans to remove import tariffs for 53 African nations, a move set to boost its trading partner status.

China has announced plans to remove tariffs on imports from all 53 African nations with which it maintains diplomatic ties, expanding a previous deal that targeted only the least developed countries. Although China has not specified when the decision will take effect, the move strengthens China's position as Africa’s top trading partner, with imports worth $170 billion in 2023. Nigeria stands to benefit significantly, particularly as it recorded a ₦5.17 trillion trade surplus in Q1 2025 — its highest in nearly two years. Despite a dip in crude oil earnings, non-oil exports rose to ₦3.17 trillion, reflecting growing diversification in Nigeria’s export base.

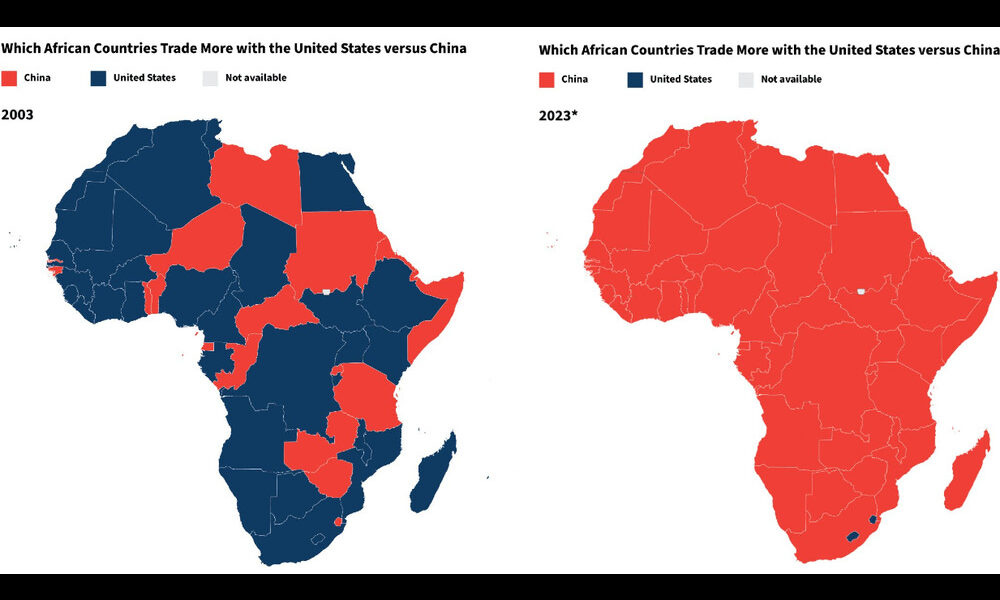

China’s decision to eliminate tariffs on imports from all 53 African countries with which it has diplomatic ties represents a major escalation of its trade engagement with the continent. Previously, this preferential access was limited to 33 Least Developed Countries, but the policy's expansion to include larger economies like Nigeria and South Africa signals a deliberate broadening of Beijing’s geopolitical and economic strategy. The move consolidates China’s position as Africa's foremost trading partner and deepens economic interdependence at a time when its global influence is increasingly contested. The policy’s geopolitical subtext is clear, reinforcing the “One China” principle through the pointed exclusion of Eswatini, the only African country that recognises Taiwan.

On paper, the economic opportunities presented by this policy are immense. The removal of tariffs is expected to make African goods more price-competitive in China’s vast consumer market, potentially boosting export revenues and stimulating much-needed economic diversification. This could encourage investment in sectors beyond the traditional export of raw materials, helping African nations develop their industrial capacities. However, the path from market access to tangible export growth is fraught with systemic challenges.

Nigeria provides a compelling case study of both the potential and the pitfalls. The timing is advantageous, as the country recorded a trade surplus of ₦5.17 trillion ($3.2 billion) in the first quarter of 2025, buoyed by a combination of elevated oil prices and rising non-oil exports, which now account for over 15% of the total. China's new policy could provide a significant boost to Nigeria's burgeoning agriculture, solid minerals, and semi-processed goods sectors. Furthermore, the ability to trade in local currencies offers a valuable opportunity to bypass the US dollar, strengthening bilateral ties while reducing exposure to currency volatility.

Despite the promise, significant hurdles remain for Nigeria and the wider continent. The potential benefits are not automatic and risk being nullified by deep-seated structural constraints, including poor infrastructure, inefficient ports, and inadequate standardisation mechanisms that limit competitiveness. Moreover, China maintains a range of stringent non-tariff barriers, including complex health and phytosanitary standards, which can hinder market access even in the absence of tariffs. Without a coherent and targeted export strategy to overcome these obstacles, African countries risk perpetuating their long-standing role as suppliers of low-value commodities rather than advancing up the global value chain.

Ultimately, while China’s zero-tariff policy is a potentially transformative gesture, its success hinges entirely on the ability of African countries to convert market access into sustainable export growth. For this to happen, policymakers must act decisively to resolve domestic export bottlenecks and support businesses in meeting the standards of the Chinese market. Without a proactive and dedicated trade strategy, the promise of access may remain just that—a promise.