The Week Ahead - A temporary, arithmetical spike

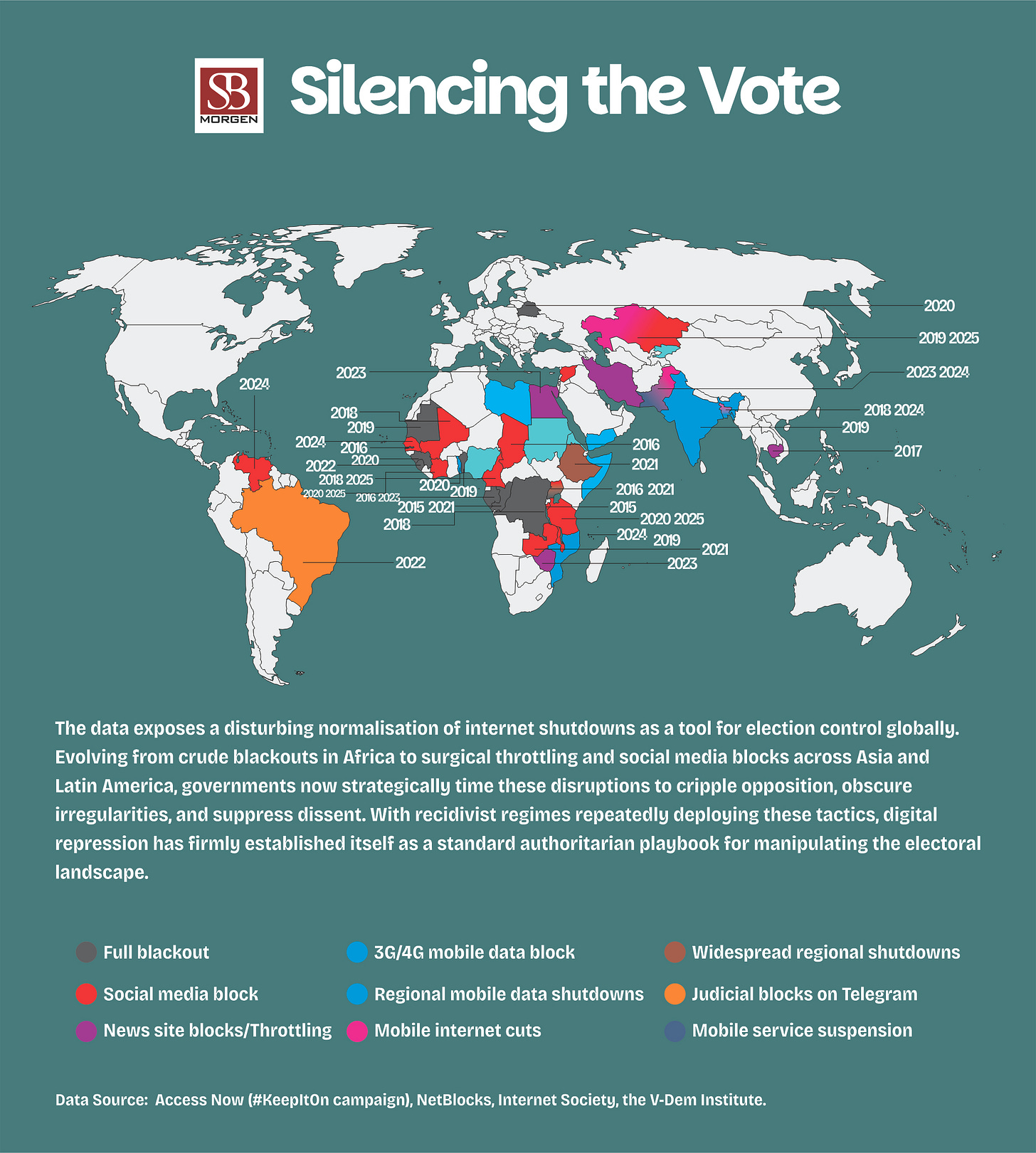

Nigeria grapples with escalating insecurity and economic recalibration; Ghana clears energy debts; Côte d’Ivoire attracts bond investors; Uganda holds elections under an internet blackout.

From Nigerian bandits to Ugandan internet blackouts, it was a week of grim arithmetic: add dead rangers and farmers, subtract school days and online access. Meanwhile, governments performed financial gymnastics: Côte d’Ivoire oversubscribed bonds, Ghana paid energy debts, and Nigeria rebased its inflation to a nicer number. As the U.S. extends perks and Silicon Valley bets on African drones, the continent’s leaders are masters of multitasking: juggling bullets, ballots, and balance sheets, all while trying to convince investors that the chaos is just a temporary, arithmetical spike.

Chart of the week

Video

This video analyses two defining events for African security: the 2025 US airstrikes in Nigeria's Sokoto State and the dramatic US operation in Venezuela. We explore why American power is applied so differently across the globe and what it reveals about sovereignty in a new strategic age. Using Nigeria as a case study, we break down the complex local realities behind the headlines in Sokoto, where the dominant armed groups are often mislabelled. The video contrasts this with the centuries-old Monroe Doctrine logic applied in Venezuela, arguing that Africa, while facing pressure, sits outside America's core sphere for direct regime change.

Podcast

The US House extended AGOA trade terms, with South Africa's access under review. Ghana cleared $1.47bn in energy debt and launched a domestic infrastructure bond. Uganda imposed an internet shutdown amid a repressive election period.

Listen here, or search for “SBM Intelligence, the week ahead” on your preferred podcast platform.

What we are following this week

US-Nigeria security cooperation escalated with new defence shipments and a warning of potential US strikes. Nigeria, disputing the religious framing of the conflict, also signed a $9 million US lobbying contract to influence policy perceptions in Washington.

A Nigerian defence technology firm, Terra Industries, raised $11.8 million in a seed round led by Palantir co-founder Joe Lonsdale’s 8VC. The startup, scaling drone manufacturing, also added 8VC’s Alex Moore to its board amid rising African security risks.

Intensifying insecurity in Nigeria saw bandits kill park rangers in Oyo, farmers in Benue, and villagers in Niger. As security operations renewed, some northern schools reopened after closures due to mass abductions, though many stayed shut, highlighting ongoing risks to education.

While Nigeria’s headline inflation rate declined to 15.2%, the NBS warned of a one-off, “artificial spike” in the December data due to CPI rebasing. The updated index now tracks 934 items, with the central bank targeting 13% inflation next year.

Ghana’s finance ministry settled $1.47bn in energy-sector arrears, including with the World Bank and major suppliers, to curb power outages. Concurrently, it launched a GH¢10bn domestic infrastructure bond for toll-funded road projects, leveraging improved macroeconomic conditions.

Côte d’Ivoire’s sovereign bond sale was heavily oversubscribed, raising 320.77 billion CFA francs to fund its budget and public investment. Concurrently, new tax breaks for certified tech startups aim to position the country as a regional digital hub.

Ahead of Thursday’s vote, Ugandan authorities severed internet access, restricted mobile services, and detained hundreds in a security clampdown. The repression, criticised by the UN, coincides with US lawmakers advancing a three-year extension of the AGOA trade act.